Section 179 Deduction Vehicle List 2024 Online – The deduction on such vehicles was capped following controversy over some business owners essentially buying luxury vehicles for personal use and writing off the full cost under section 179. . Section 179 is a federal rule intended to help small and medium-sized businesses by allowing them to receive specific tax benefits sooner if they choose to do so. If you purchase assets for your .

Section 179 Deduction Vehicle List 2024 Online

Source : www.bobmoore.comMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

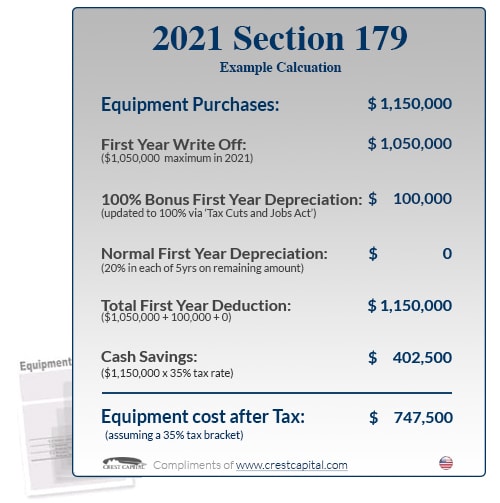

Source : www.joerizzamaserati.comSection 179 & Bonus Depreciation Saving w/ Business Tax Deductions

Source : www.commercialcreditgroup.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comSection 179 Tax Deduction Vehicles List | Bell Ford

Source : www.bellford.comUnderstanding The Section 179 Deduction Coffman GMC

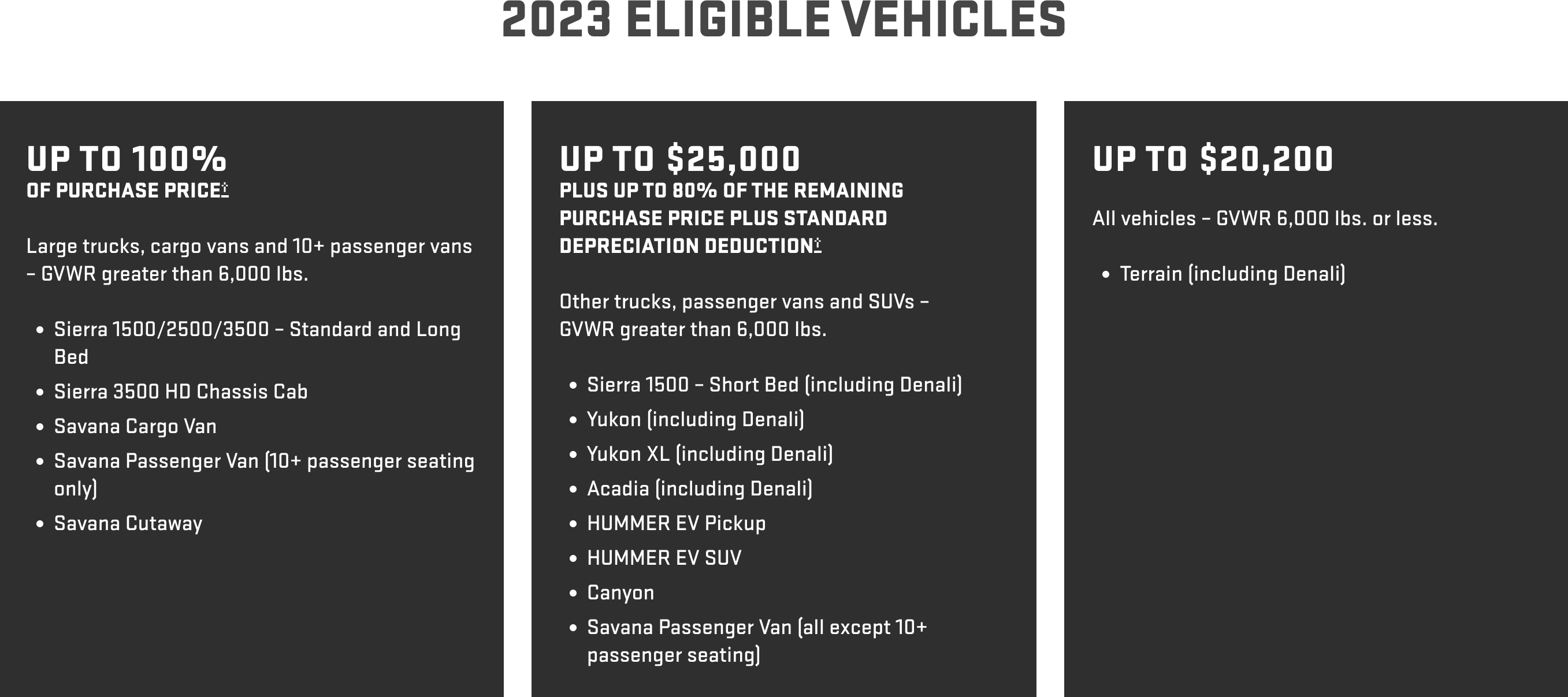

Source : www.coffmangmc.comSection 179 Deduction Vehicle List 2023 Mercedes Benz of

Source : www.mercedesoflittleton.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comBEST Vehicle Tax Deduction 2023 (it’s not Section 179 Deduction

Source : m.youtube.comSection 179 Deduction List for Vehicles | Block Advisors

Source : www.blockadvisors.comSection 179 Deduction Vehicle List 2024 Online Section 179 Eligible Vehicles at Bob Moore Auto Group: Commercial vehicle sales are expected to see a boom as the year comes to an end, thanks to an expiring tax deduction. Section 179 of the U.S. Internal Revenue Code allows businesses to deduct up . A fraction of the time a piece of equipment, vehicle, or software is used for business purposes is enough to qualify for a deduction under Section 179. To calculate the monetary amount that qualifies .

]]>